Navigating FINRA compliance can be overwhelming for financial organizations, especially when dealing with complex rules and operational constraints. Explore the challenges of staying compliant, the risks of manual oversight, and how third-generation DMS platforms can streamline compliance efforts.

People who work in Financial Services in the United States are likely aware of the Financial Industry Regulatory Authority, also known as FINRA. While not a government regulatory agency, like the Securities and Exchange Commission (SEC), FINRA acts as a self-regulatory organization with the goal “to protect investors and ensure the market’s integrity” by overseeing broker-dealers in the United States.

Understanding FINRA and Its Role

As part of that mission, FINRA oversees over 624,000 Broker-Dealers, Capital Acquisition Brokers, and Funding Portals while it also analyzes billions of daily market events. While no organization is required to submit to FINRA oversight, the vast majority of Financial Services organizations understand that being compliant with the guidelines offers a sense of security to investors.

A Glimpse Into FINRA’s Compliance Rules

Still, while a Broker-Dealer may see the need to be compliant with FINRA’s guidelines, following those guidelines can be a logistical chore. Let’s take a look at just one rule that Capital Acquisition Brokers are to follow. Keep in mind that this is just one rule, and there are many more like this one:

(a)(1) Unless otherwise permitted by FINRA, a capital acquisition broker must suspend all business operations during any period in which it is not in compliance with applicable net capital requirements set forth in SEA Rule 15c3-1.

(2) FINRA may issue a notice pursuant to FINRA Rule 9557 directing a capital acquisition broker that is not in compliance with applicable net capital requirements set forth in SEA Rule 15c3-1 to suspend all or a portion of its business.

(b) No equity capital of a capital acquisition broker may be withdrawn for a period of one year from the date such equity capital is contributed, unless otherwise permitted by FINRA in writing. This paragraph does not preclude a capital acquisition broker from withdrawing profits earned.

(c) Subordinated Loans, Notes Collateralized by Securities and Capital Borrowings

(1) All subordinated loans or notes collateralized by securities must meet such standards as FINRA may require to ensure the continued financial stability and operational capability of the capital acquisition broker, in addition to those specified in Appendix D of SEA Rule 15c3-1.

(2) Unless otherwise permitted by FINRA, each capital acquisition broker that is a partnership and whose general partner enters into any secured or unsecured borrowing, the proceeds of which will be contributed to the capital of the broker, must submit to FINRA such information as needed by FINRA to determine whether such proceeds qualify as capital acceptable for inclusion in the computation of the net capital of the broker.

https://www.finra.org/rules-guidance/rulebooks/capital-acquisition-broker-rules/411

That sounds like a lot of fun, right? Sure, you could absolutely have a team of experts on staff to manage all of this, but that will be costly, and would likely slow operations to a crawl.

Streamlining Compliance with a Software Solution that Meets Your Needs

This is when you might want to look at a FINRA-compliant software solution. By investing in a solution that processes transactions against the FINRA guidelines, you’ll be able to be compliant with minimal disruptions to your FinServ business.

If your organization has adopted Google Workspace for your core business applications, then you would likely want a solution that integrates tightly with Google Drive.

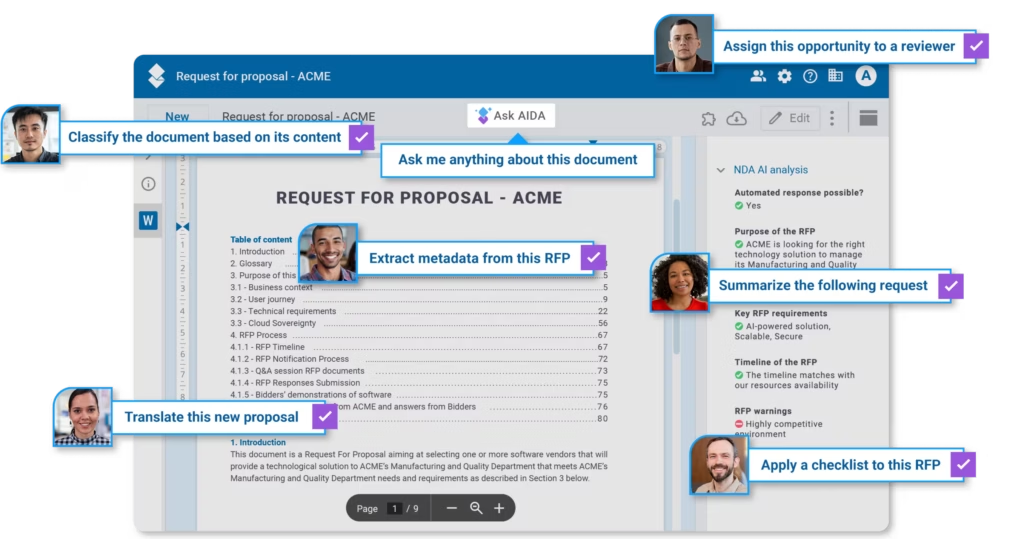

To that end, you might want to consider evaluating AODocs for Financial Services. AODocs is tightly integrated with Google Drive and Workspace (formerly G Suite) to offer a comprehensive solution that is ideal for highly regulated industries like Financial Services. In addition to meeting FINRA guidelines, the same solution is used to meet SEC regulatory oversight requirements.

No matter what solution you may choose, be sure that it is capable of meeting all of your needs in a manner that is intuitive and efficient.