Staying compliant with SEC and FINRA retention rules and regulations has long been a challenge for financial services firms striving to move fast without sacrificing control. Our partnership with Google Workspace provides an out-of-the-box records management solution—AODocs Compliance Archive—that enables seamless collaboration with built-in regulatory compliance features for broker/dealer electronic records.

Financial services organizations operate in a high-stakes regulatory environment where efficiency and control must go hand in hand. Navigating compliance—particularly with the Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA)—can be both complex and resource-intensive. Now, there’s some welcome news for firms looking to achieve both real-time collaboration and resilient retention of financial and banking records.

That’s why we’ve partnered with Google Workspace to deliver an out-of-the-box records management solution built for tightly regulated industries.

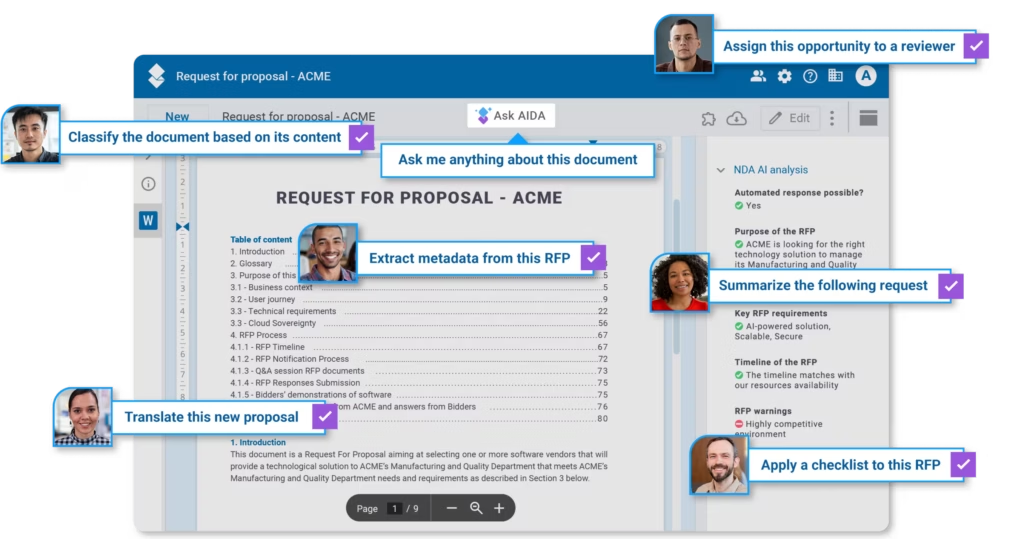

AODocs Compliance Archive combines the collaborative power of Google Drive with robust retention and audit controls—offering financial institutions a modern, scalable way to manage regulated documents without compromising productivity or compliance.

Why This Matters

At its core, this new solution addresses a longstanding pain point in financial services: how to stay compliant with rigorous regulations while maintaining business agility.

- Google Workspace offers fast, flexible collaboration for teams across the organization.

- AODocs Compliance Archive adds a secure framework for document retention and archiving that aligns with SEC and FINRA rules.

For firms managing securities-related communications, trade confirmations, customer records, or internal oversight documentation, AODocs Compliance Archive solution built on top of Google Workspace provides a path to enforce policy-based controls—without slowing down day-to-day operations.

The Regulatory Retention Rules Landscape: Complex, Costly, and Critical

FINRA is a self-regulatory organization that oversees more than 624,000 U.S. broker-dealers, capital acquisition brokers, and funding portals. While not a government agency, FINRA works closely with the SEC to maintain market integrity and protect investors.

Compliance with FINRA’s rules isn’t optional for most financial firms—it’s a core part of their license to operate. But staying compliant can be far from straightforward.

Failure to comply can trigger business suspension or regulatory scrutiny. Even a seemingly administrative oversight can result in operational disruptions or penalties.

This challenge becomes even more complex as firms must also comply with SEC Rule 17a-4—a cornerstone regulation that mandates how electronic records must be preserved, indexed, and made auditable. It requires firms to retain certain documents for specific durations, in a non-rewritable, non-erasable format (commonly known as WORM—Write Once, Read Many).

The rule also sets strict guidelines for record accessibility, metadata capture, and third-party access. Meeting these requirements demands not only robust technical capabilities but also a platform purpose-built for compliance in a digital environment.

The reality? Many firms face two unsatisfactory choices:

Either companies build an in-house compliance operation, which is expensive, rigid, and prone to human error. Or they can rely on manual oversight. But this approach carries risks and is increasingly unsustainable in today’s fast-paced, digital-first environment.

Why New Generation Document Management Matters

On the face of it, Legacy Document Management Systems (DMS) could have been the go-to solution for financial institutions’ compliance needs. But they were not built for the cloud era—or for the modern financial regulatory landscape. Today’s firms need a third-generation solution that is:

- Integrated: Built into platforms employees already use, like Google Workspace.

- Compliant: Designed to align with SEC rules for retention, access, and auditability.

- Efficient: Flexible enough to scale across teams without adding administrative burden.

That’s where the AODocs + Google Workspace solution fits in.

Built for Financial Services Teams

If your organization already uses Google Workspace for communication, collaboration, and productivity, AODocs is a natural extension. It embeds compliance features into the daily workflows of your teams—no need to switch tools or retrain staff.

Whether you’re archiving investor communications or enforcing retention policies for sensitive banking records, the platform enables you to:

- Apply document controls directly in Google Drive.

- Automate retention and audit policies.

- Meet SEC and FINRA regulatory requirements.

- Reduce compliance risks without introducing workflow friction.

A Practical Step Toward Smarter Compliance

In summation, the AODocs solution built on top of Google Workspace offers a much-needed win-win for financial firms: a way to be compliant without slowing down.

For CIOs, compliance officers, and business leaders in finance, it’s an opportunity to rethink how technology can serve both operational agility and regulatory rigor.

To learn more about the Workspace FINRA compliance updates, please visit the blog here.

For more information about how this solution supports your SEC and FINRA compliance strategy, see our Record Management and Retention or Banking and Insurance page.