Manual document handling slows down mortgage processing and increases compliance risk. New-generation document management, powered by reliable AI, can now automate data extraction, consistency checks, and early financial assessments — helping lenders make faster, more confident decisions.

The problem with today’s mortgage application workflows

Mortgage applications are among the most document-heavy processes in retail banking. Loan officers must collect, verify, and archive dozens of files for each applicant — from identity documents and pay stubs to tax returns, purchase agreements, and proof of funds.

The result? Long review cycles, fragmented workflows, and high operational costs. Manual checks not only drain time but also increase the risk of errors, incomplete files, and inconsistent compliance reporting.

What are the key features of AI-enabled document management for lenders and banks?

Recent advances in document management are transforming this process.

Modern AI systems can automatically:

-

Ingest files from emails or shared folders

-

Classify and archive them in the correct repository

-

Extract and cross-verify key data points, such as identity details, employment information, and income figures

-

Highlight anomalies or missing documents before they slow down underwriting

Instead of manually comparing numbers across pay stubs and tax returns, loan officers can now rely on AI to surface inconsistencies and summarize the applicant’s financial stability within minutes.

What are the potential benefits for banking teams?

AI-powered document management doesn’t replace bank employees and underwriters — it empowers them. With cleaner, verified data and full traceability of every AI action, teams can focus on analysis and decision-making instead of repetitive checks.

The benefits add up quickly:

-

Shorter turnaround times for loan applications

-

Consistent compliance and governance across every file

-

Improved accuracy and auditability

-

A better customer experience through faster feedback

How does switching from concept to reality work concretely?

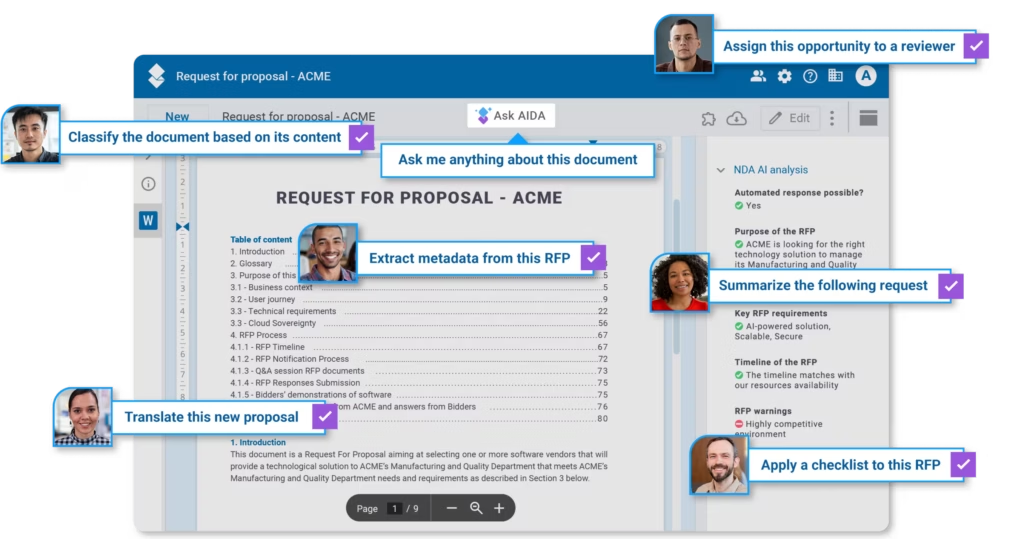

In our latest Mortgage Application Review demo, we show how these capabilities can come to life using AODocs AI and its assistant AIDA. The system automates document capture, cross-checks consistency across all submissions. It even reliably answers complex questions, such as “Do the declared income figures align with the tax returns?” by accessing only validated, up-to-date files.

When applied on the correct documents and with proper controls and tagging, what once took days can now happen in minutes — with accuracy, governance, and transparency built in.

Want to learn more?

- Watch the video 🎥 Accelerate Mortgage Applications with AODocs AI

- AODocs for Banking and Insurance

- Get your demo now – see it in action